Bank Statements for Down Payment

What are bank statements for a down payment?

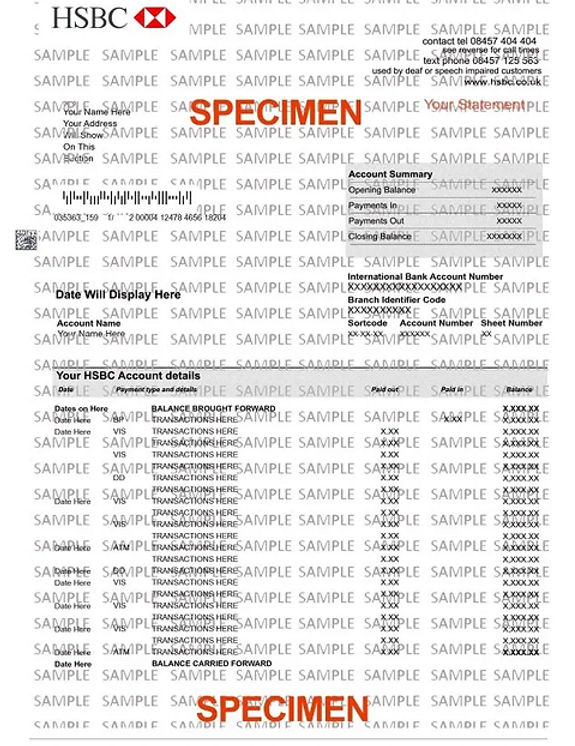

Bank statements are a transaction history for any funds used for down payments or closing costs. These statements should show your name or have supporting documentation to show account ownership.

Why do lenders require bank statements for a down payment?

The Government of Canada requires lenders/brokers to show the 90-day history of all funds used for either a down payment or closing costs; in order to comply with FINTRAC regulations (Anti-money laundering).

How do I get my bank statements for the down payment?

-

If your down payment is coming from savings or investments you will need to provide a 3-month history (Canadian Anti-Money laundering rules). If you do internet banking you can print out a 3-month history and if your name is not on the printout please provide an older statement to match up the accounts. Alternatively an online “summary of accounts” should have your name on it allowing us to match up the 3-month history account to your name. Please note some investment statements are issued quarterly so please provide the most recent quarterly statement and online statement reflecting an up-to-date balance.

-

If your down payment is coming from the sale of a property the lender will require a copy of the sale contract, along with an addendum that subjects have been removed or a copy of the “Order to Pay” you would have received at the lawyer’s or notary, and a copy of the most recent mortgage statement.

-

Any “gifted funds” may only come from a direct family member. The lender will require a gift letter along with confirmation of the gifted amount being deposited into the purchaser’s account and the lender can request confirmation of the source of funds. Please note the amount being deposited into the account must match up to the amount stated on the gift letter. Most lenders have their own gift letters; therefore, I will provide the gift letter. The gifted funds should be deposited into your bank account a minimum of two weeks before the completion date.

Note: mobile statements do not have all the information. Bank statements need to be from a desktop or from your bank branch.

_edited.png)